Request For More Information

Fill out the form below to receive additional details and insights about our offerings. We’re here to help you make informed decisions.

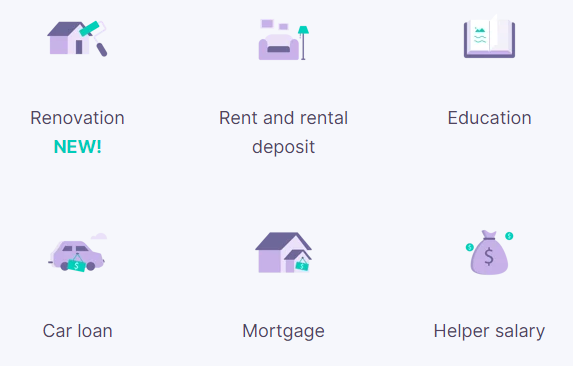

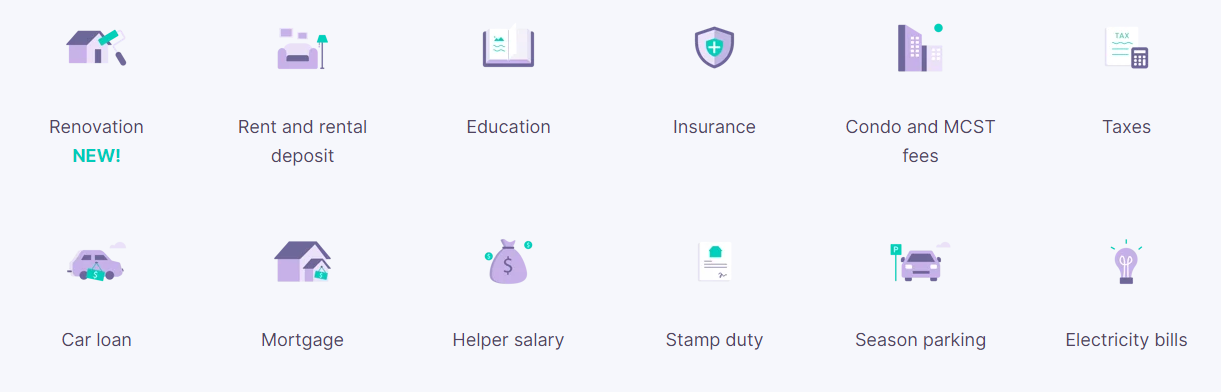

Earn miles, points & cashback on local & overseas payments currently made by cash, cheque or bank transfers, even where credit cards are not accepted.

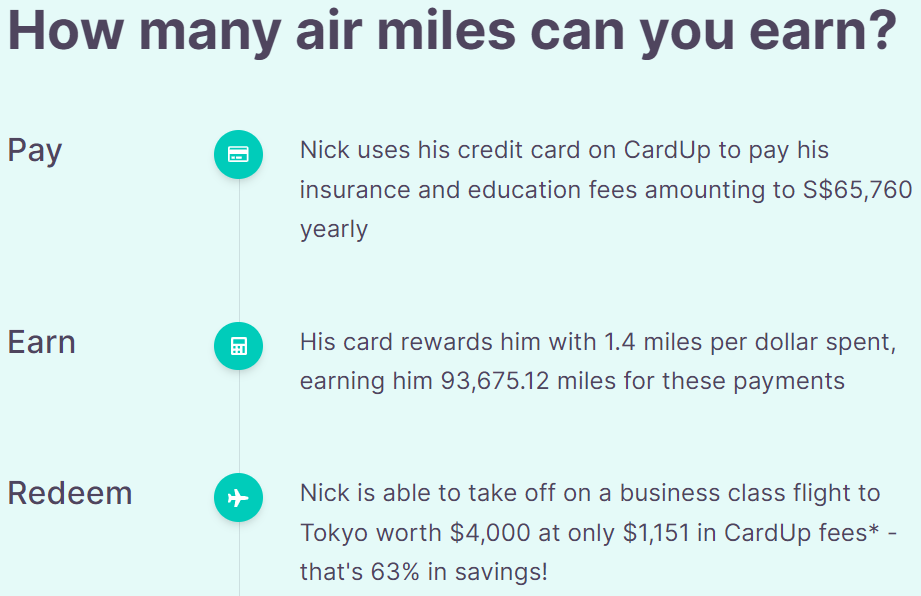

Be it domestic or international expenses, CardUp allows these payments that were previously made by cash, cheque or bank transfer – to be shifted onto a credit card, even if your recipients don’t accept cards or have a CardUp account. You can now earn air miles and points from your large expenses that don’t typically earn you card rewards.

Sign up for a free Cardup account and enter your payment details. You can pay anyone, even if they don’t use CardUp.

Sit back and watch your card rewards grow faster than ever and pay only when card bill is due.

CardUp charges a transaction fee to enable card payments in areas where cards are not accepted today so you can start earning rewards every time you pay your large expenses!

* CardUp charges a transaction fee to enable card payments in areas where cards are not accepted today so you can start earning rewards every time you pay your large expenses!

Use CardUp Rewards Calculator to see how much rewards you can earn from your personal expenses!

Disclaimer:

This website contains affiliate links to CardUp.co which belongs to our collaboration partner CardUp Pte. Ltd. Clicking certain links will redirect you to CardUp.co for more information or to complete the onboarding process. This information provided here is intended only for informational purposes only and may not be up-to-date. Please visit CardUp.co for the most accurate and up-to-date details. By clicking on links to CardUp.co, you will be subject to their Privacy Policy and Terms Of Service, which you agree to by using this site. All trademarks and intellectual property are the property of CardUp Pte. Ltd., used here solely for informational purposes.

Fill out the form below, and we’ll curate the best solutions for you and your team!